Inventory adjustment account

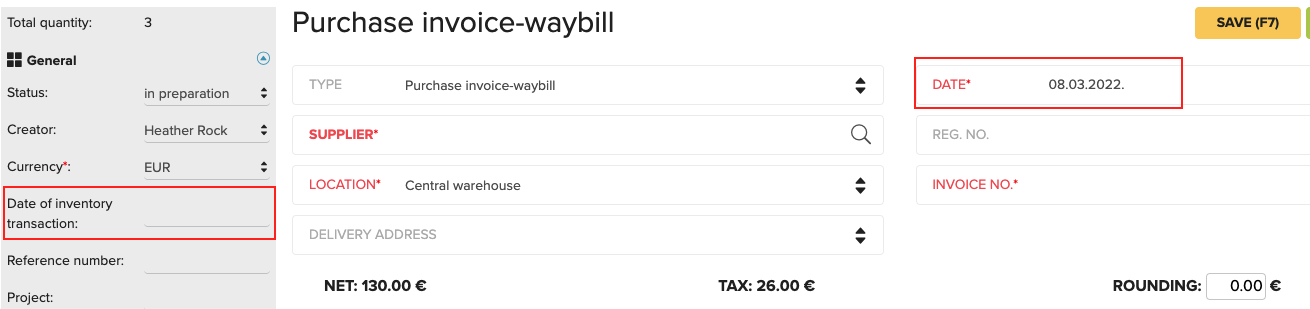

The goods are taken into inventory when the document is confirmed. In Erply Inventory, the “Date of inventory transaction” is added based on the document confirmation date. For example, if I confirm the document today, then the goods are taken into inventory with today’s date. Sometimes it can happen that goods are taken into inventory a few days later. If this occurs, an inventory adjustment account is needed.

How can we see the differences caused by different dates in Erply Inventory and ERPLY Books?

In ERPLY Books, the date is taken from the field written in red unless it is configured differently. The inventory adjustment account balance has to be with the value zero by the date when the invoice was confirmed.

For example, if a company is using an “Inventory adjustment account” and the company bought inventory goods in total 100 € + VAT, has the document date 31.01.2022 and the document was confirmed on 05.02.2022, then the following entries are created:

- D: Inventory 100€ with the date 05/02/2022

- K: Requirements for suppliers 120€ with the date 31/01/2022

- D: Value added tax 20€ with the date 31/01/2022

- K: Inventory adjustment account 100€ with the date 05/02/2022

- D: Inventory adjustment account 100€ with the date 31/01/2022

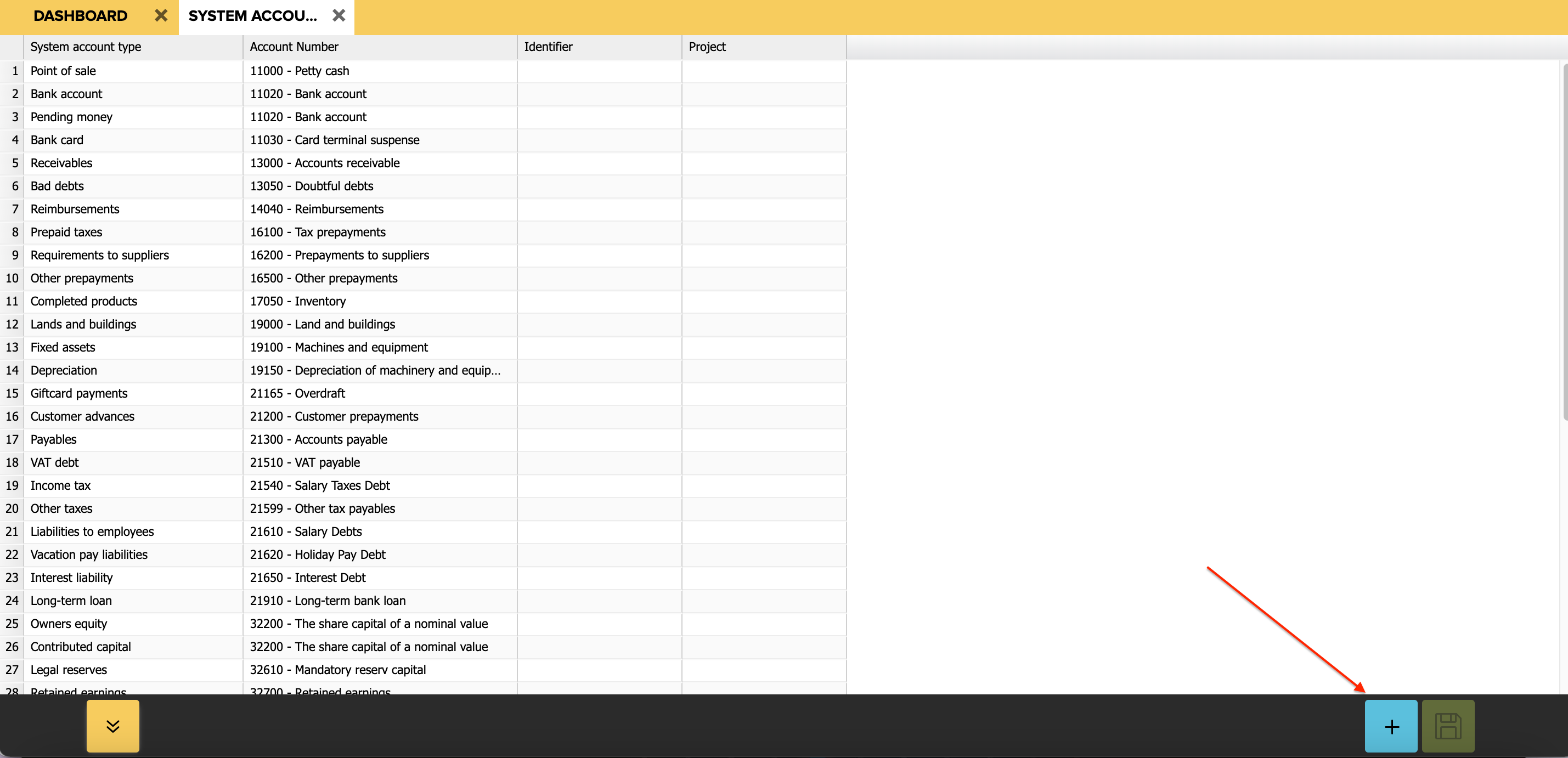

You can add an Inventory adjustment account from ”Settings -> Initial Data -> System Accounts” and press on the plus icon to add a new row.

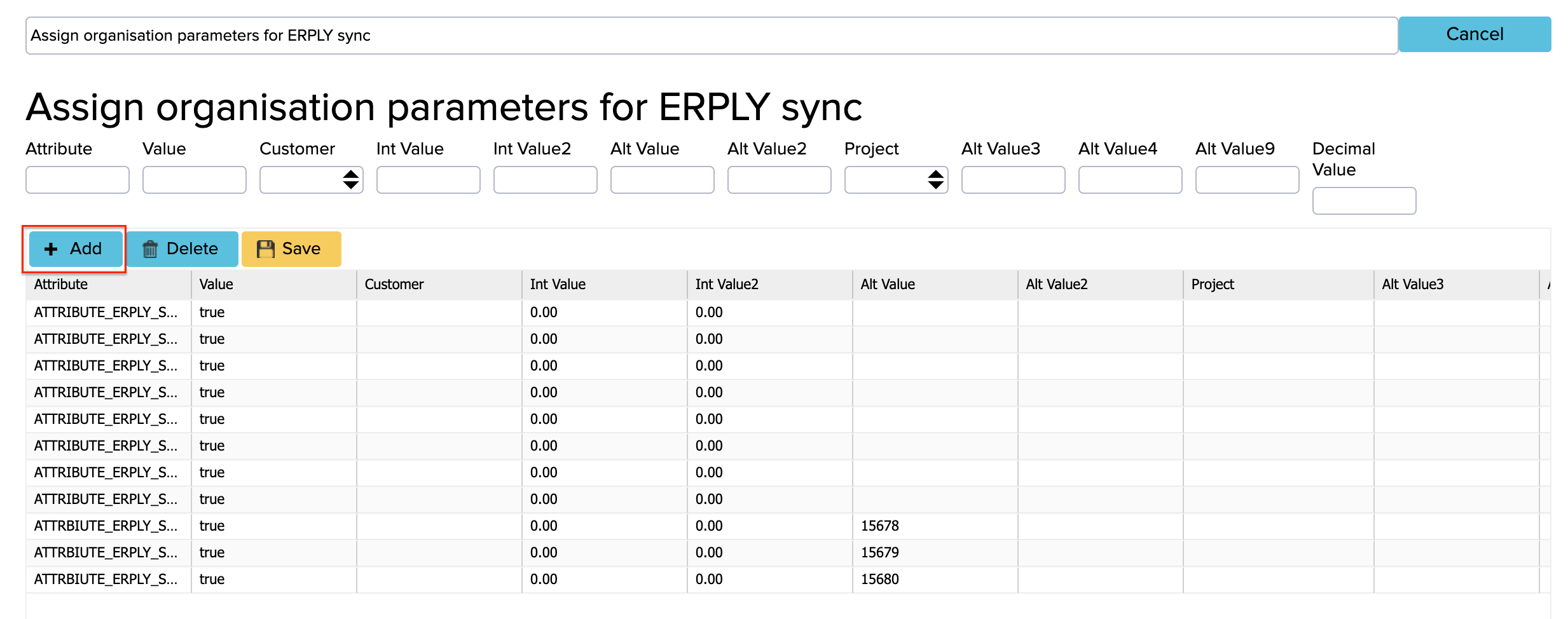

For the inventory adjustment account, you also need to configure one sync parameter. Search from the dashboard “Assign organization parameters for ERPLY sync” and press the blue “Add” button to add a new row where you can write the parameter: ATTRIBUTE_ERPLY_SYNC_SET_INVENTORY_TRANSACTION_DATE_SEPARATELY