Creating a Budget and checking it on ERPLY Books

Creating a Budget in ERPLY Books involves the following:

- entering the expected outcome of the accounts;

- comparing the expected outcome of the accounts.

How to create?

The process of creating a budget looks like this:

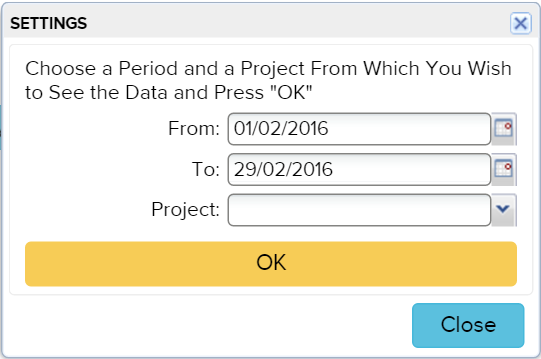

As you can see, you can select the date range (preferably at the beginning and at the end of the month), and project (optional).

Let’s review an example, if you want to add a full year profit and loss budget comparison.

- First, you need to enter the balances for all the months.

- While inserting the balances, keep in mind the following conditions:

- The period should start with January;

- All the balances have to be cumulative. The revenues and expenses of February has to include the balance of January, not only contain sales made in February. For example: If the expected sales in January is 10,000, and in February 8000, then the expected balance of February is 18000);

- If you only want a cost-revenue comparison, you can leave balance accounts empty.

Budget comparison with reality

In order to view the comparison of budget and reality, use the search module on the main page and search for “Compare Budget to Account Balances”.

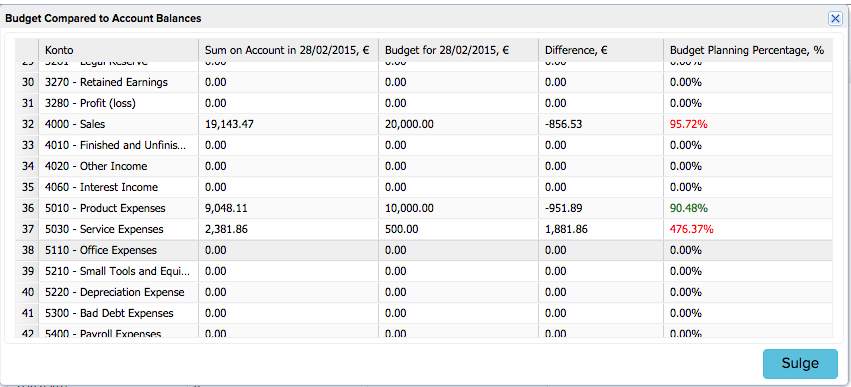

Then, the program asks for the date range and the project. For example, if you want to compare the balances of February, mark the date as the end of February. The result looks like this:

As we can see, we assumed that our revenues in February are going to be 20 000. In reality, we have collected 19 143.47, that is 856.53 less than we had planned which means we achieved 95,72% of the goal we projected. Since we have not achieved the objective of revenue, it is written in red.

The cost side, as we can see, the product expenses are also in deficit. But it is a good thing – the cost has been reduced – therefore the result is written in green.

In conclusion, the budget comparison shows the summary of deficit/surplus and what is the percentage of fulfilling the goal.