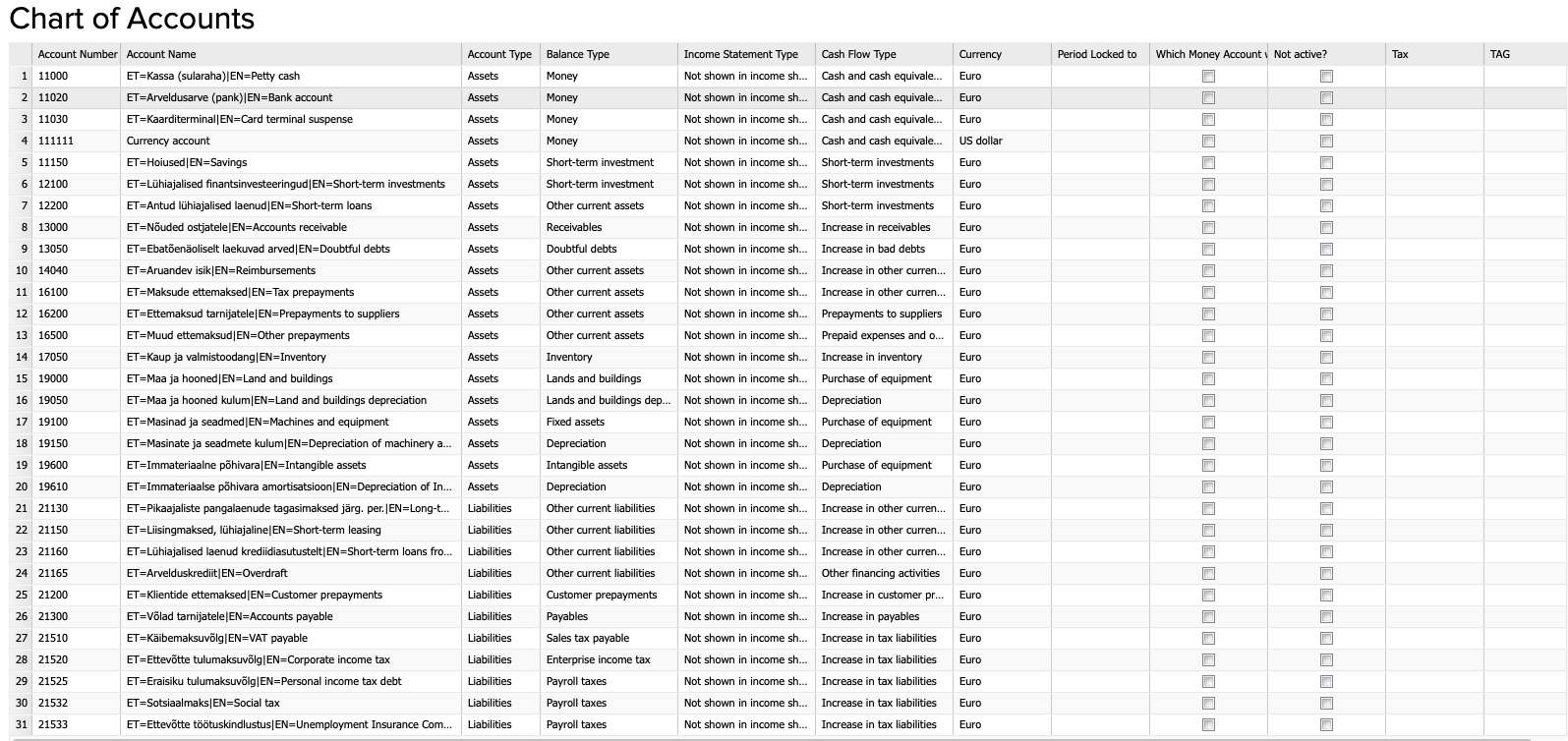

Chart of accounts

In ERPLY Books, the chart of accounts can be managed if you go to ‘’Accounting” -> “Chart of accounts’’. There you can see that every account has an account number, account name and different types of information listed in columns.

- There is also a ‘’Currency’’ column. Only a money account can have a different currency than your company’s currency.

- The ‘’Period locked to’’ column is for locking an account if the account’s locking date must be after the company’s locking date. For example, if you have created all your bank account transactions, then you can lock your bank account and no transactions can be changed, added or deleted on the bank account before the locking date.

- The ‘’Tax’’ column is used for automatic conversions for the taxes.

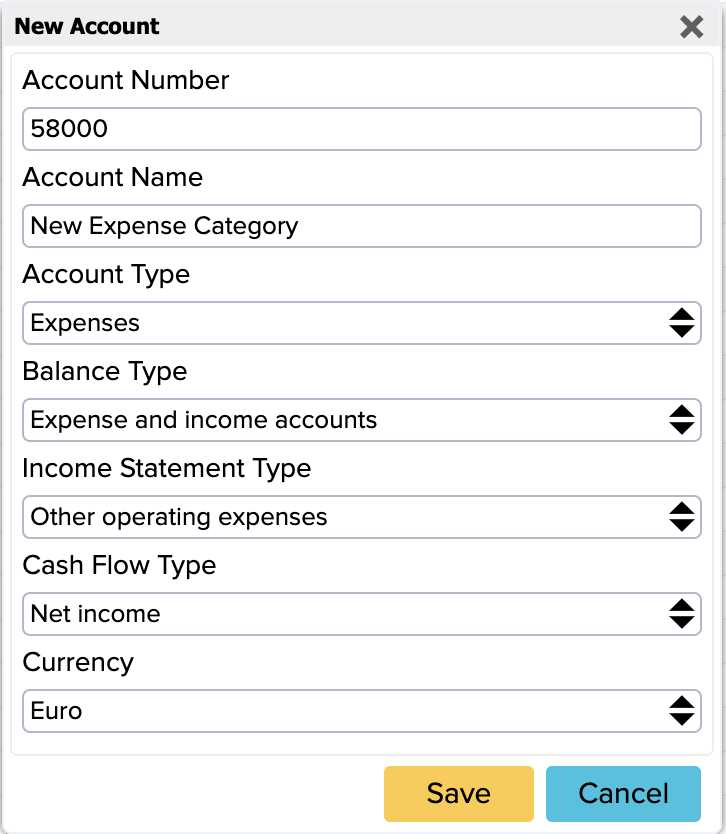

Creating a new account

If you want to add a new account, click on the + sign below. A window will open where you have to fill in the account information. Suppose you want to add a new expense account:

- Account Number: enter the appropriate account number

- Account Name: name as you like

- Account Type: Expenses

- Balance Type: balance type is added automatically because you don’t want to see this in balance sheet, instead you want to see this in the profit level in the balance sheet

- Income Statement Type: for example ‘’Other Operating Expenses’’

- Cash Flow Type: this is by default ‘’Net Income’’ but you can also change this

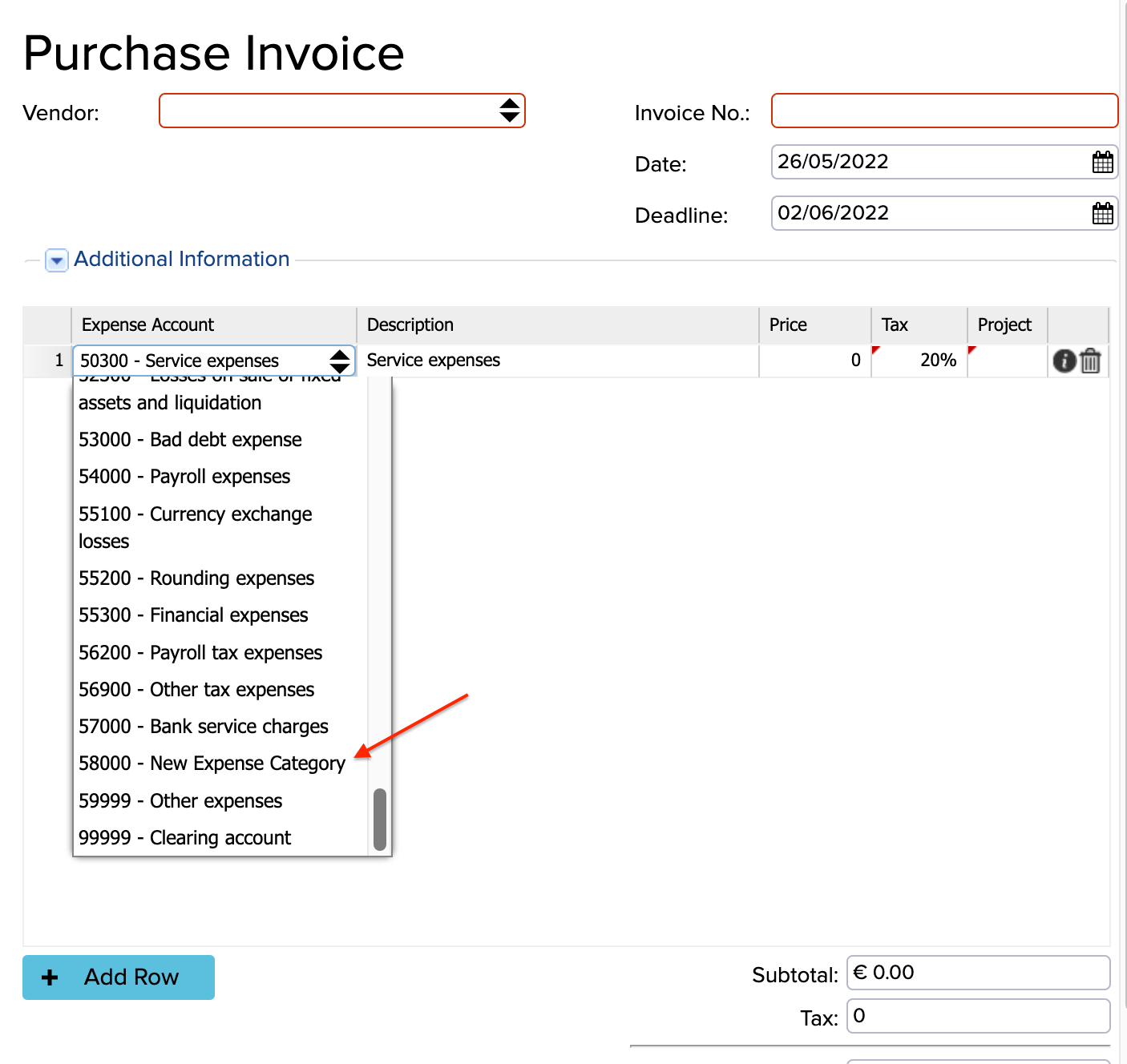

You can see a list of all available accounts when selecting an account on an invoice, for example. When you open a new purchase invoice (Purchases -> Purchase Invoice (Add New)) and select the item Expense account you can see that the new expense account you added is also there:

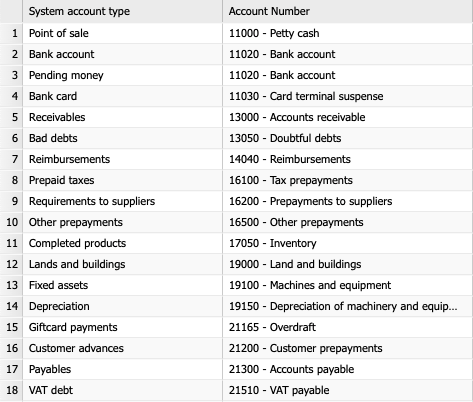

System Accounts

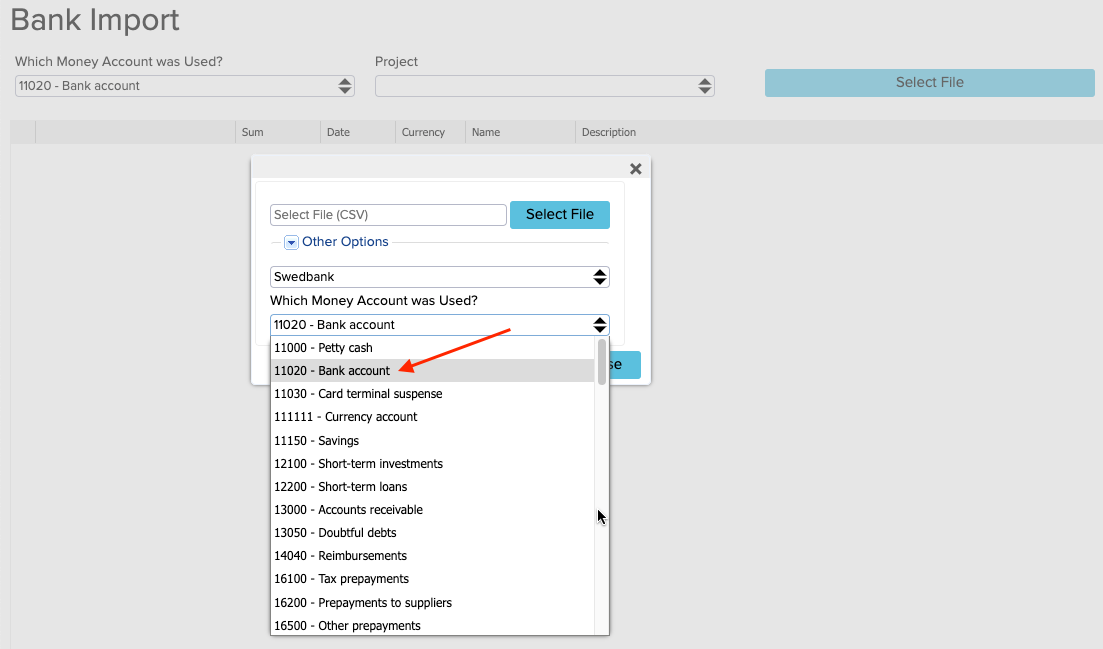

You can find System accounts if you go to Settings -> Initial Data -> System Accounts. System accounts are default accounts in ERPLY Books which are used for different transactions. For example Bank Account, Receivables, Requirements to Suppliers, Customer Advances, Payables, Fixed Assets and other system accounts. You can change these accounts if needed. Make sure to click on the green Save button to save any changes you wish to keep.  One of the most used accounts is the Bank Account. When you are doing a bank import, then the system will give you this Bank Account by default.

One of the most used accounts is the Bank Account. When you are doing a bank import, then the system will give you this Bank Account by default.  Another very often used account is the Account Receivables. This account is used by default when you create a sales invoice or receive payments for sales invoices. The Requirements to suppliers account is also used often. These are the vendor prepayments, so when you add a prepayment to the supplier, it uses the Prepayments account by default. When you add a new fixed asset, then the Fixed Assets account is automatically used. The Depreciation account is used by default for Accumulated Depreciation. This is used when you are calculating depreciation (Accounting -> Calculate Depreciation). You can change it for every fixed asset individually when you open Purchase and Sales Articles.

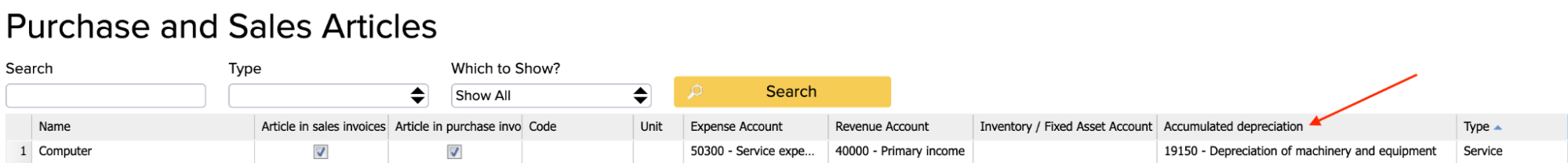

Another very often used account is the Account Receivables. This account is used by default when you create a sales invoice or receive payments for sales invoices. The Requirements to suppliers account is also used often. These are the vendor prepayments, so when you add a prepayment to the supplier, it uses the Prepayments account by default. When you add a new fixed asset, then the Fixed Assets account is automatically used. The Depreciation account is used by default for Accumulated Depreciation. This is used when you are calculating depreciation (Accounting -> Calculate Depreciation). You can change it for every fixed asset individually when you open Purchase and Sales Articles.  If the cell is empty under Purchase and Sales Articles, then the System Account ‘’Accumulated Depreciation’’ is used. The VAT Debt system account is used by default for the VAT Payables. You can overwrite it under the Tax Rates (Settings -> Tax Rates) setting but when you add a new tax rate, then the VAT Payables system account is chosen by default. Books also often uses Primary Income accounts. For example, if you create a new sales invoice or if you synchronize from a different system and if you don’t change any rules, it always uses the Primary Income account. When you add a new purchase invoice, then the selected account is the Service expenses account by default. Following video shows how to manage chart of accounts in ERPLY Books:

If the cell is empty under Purchase and Sales Articles, then the System Account ‘’Accumulated Depreciation’’ is used. The VAT Debt system account is used by default for the VAT Payables. You can overwrite it under the Tax Rates (Settings -> Tax Rates) setting but when you add a new tax rate, then the VAT Payables system account is chosen by default. Books also often uses Primary Income accounts. For example, if you create a new sales invoice or if you synchronize from a different system and if you don’t change any rules, it always uses the Primary Income account. When you add a new purchase invoice, then the selected account is the Service expenses account by default. Following video shows how to manage chart of accounts in ERPLY Books: