Accountscoring integration

Make high quality credit decisions by trusting Accountscorings’ collected and analysed background information!

Accountscoring is an Estonian company that offers credit scoring services. It collects and analyses the background information of individuals and companies. The company is a trusted partner to many banks, lenders, and telecommunications companies that need input information for scoring models appropriate to their risk appetite.

Operating countries: Estonia, Latvia, and Lithuania.

Using ERPLY Books? See how you can benefit from using Accountscoring:

- Accountscoring is a trusted partner and has integrations with the main banks in Estonia

- You can import bank statements through this integration

- ERPLY Books users can automate and streamline their payment handling process with Accountscoring because payments “flow in” every day automatically.

- It is possible to identify patterns within data. Find transaction regularity, matches, and anomalies. Discover outliers and analyse transactional data in more depth.

- Open banking improves the relevance of services suggested to consumers which innately increases the chances of customer engagement. The more personalised a service is to a customer’s needs, the greater the chances the customer will interact with the brand, which most likely increases brand awareness.

- Accountscoring downloads the transactions from the bank and the ”green” transactions are saved immediately to ERPLY Books while the rest stay waiting for a bank import.

Using Accountscoring? See how you can benefit from using ERPLY Books:

- After Accountscoring finishes downloading the transactions from the bank, ERPLY Books synchronises the transactions from Accountscoring and delivers in the same way as other automated banking imports (“green” transactions are saved immediately and the rest stay waiting for a bank import).

- Automatic synchronisation is either hourly or manual.

- Thanks to the ERPLY Books bank import functionality (which can automate up to 100% of all payments), this offers unique value:

- Accountants can automate the processes of all of their small businesses by making sure all payments come to Books automatically (removing file down-file up manual labour) and using a partner panel only to handle payments that the system could not handle automatically

- If you have a website where you make sales and have made it possible for customers to pay via wire transfer – then the payment process is still automatic. For example, if a customer pays via wire transfer, then you can set Nordigen to sync once an hour, and within an hour the payment is in Books. If the customer correctly adds an order no. to the payment description, then Books can automatically connect the order with the payment and one hour after making the payment, people working in the warehouse can fill the order.

- All sizes of companies that need to handle bank payments can now automate payables-receivables

- If your accountant goes on vacation, then payments still go to Books and Books can do the accountant’s work by connecting as many payments as possible.

Consider this:

- Accountscoring has access to your bank account for 90 days and every 90 days you need to update the access.

- Automatic synchronization is done every hour or the synchronization can be done manually.

Price:

The Accountscoring price for automatic synchronization is 10 EUR and 0 EUR for manual synchronization.

Accountscoring integration configuration

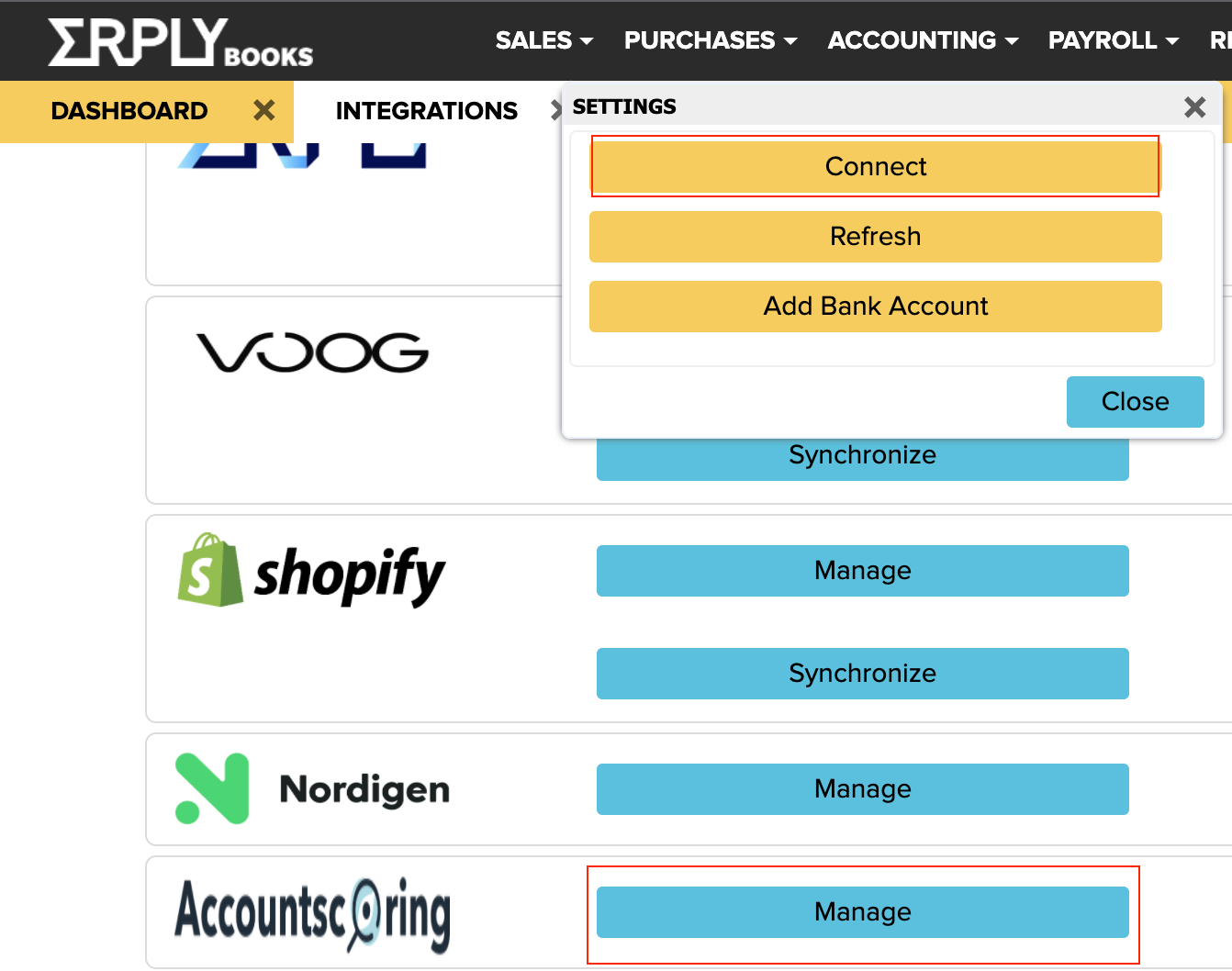

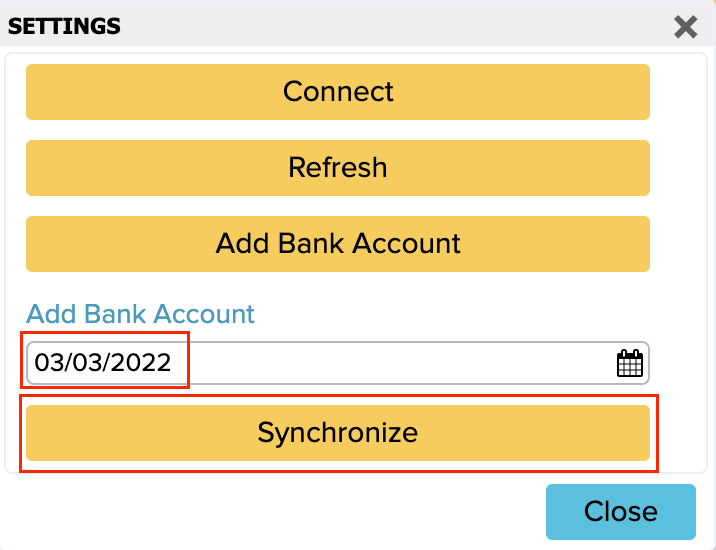

For integration, open “Settings -> Integrations” in ERPLY Books, search Accountscoring on that page and click “Manage”. Then a new window opens.

1.Press the “Connect” button – it makes the connection in Accountscoring

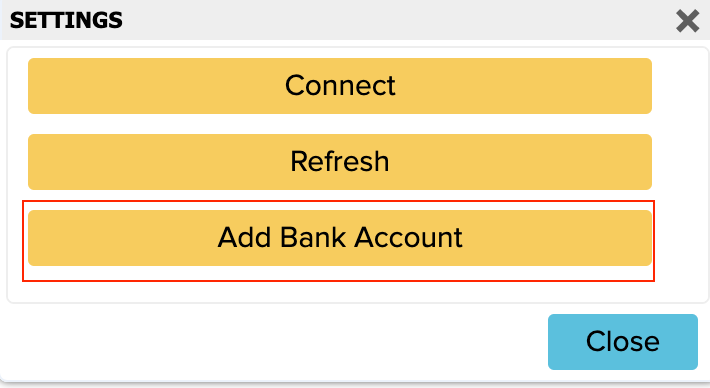

2. Now click on “Add Bank Account” and determine all bank accounts in Books you want to connect in Accountscoring. For that to work, all of your bank accounts have to be set up correctly (you can do it from Settings -> Organization Data). ERPLY Books connects through the IBAN of selected bank accounts.

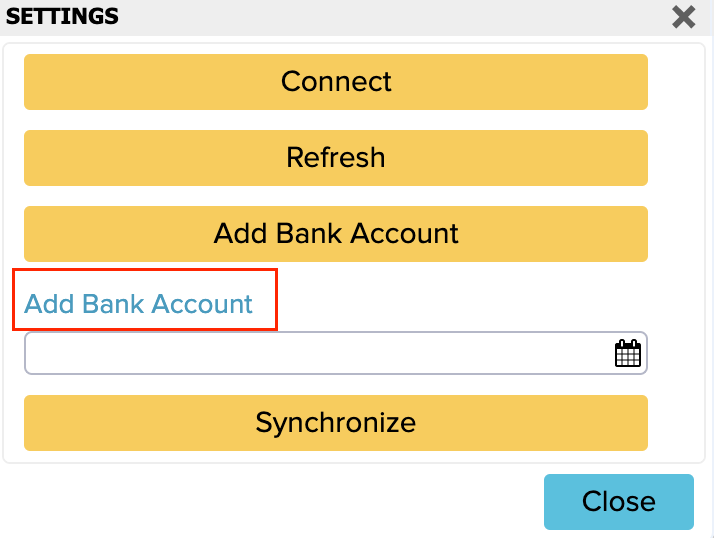

3. Click on the blue “Add Bank Account” button and you will be routed to the Accountscoring page.

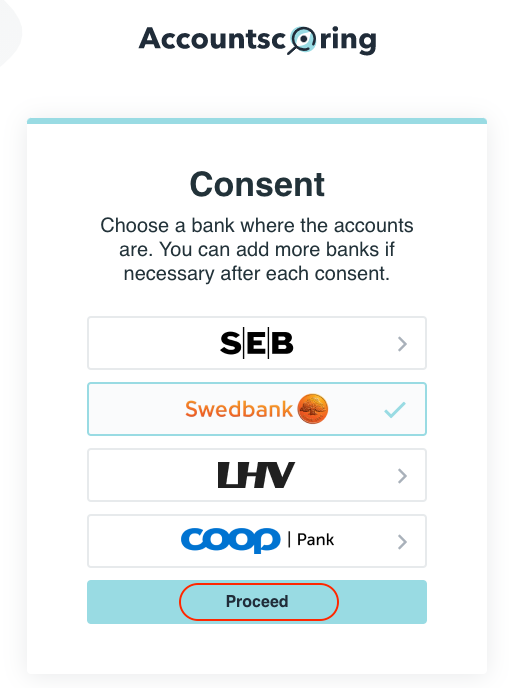

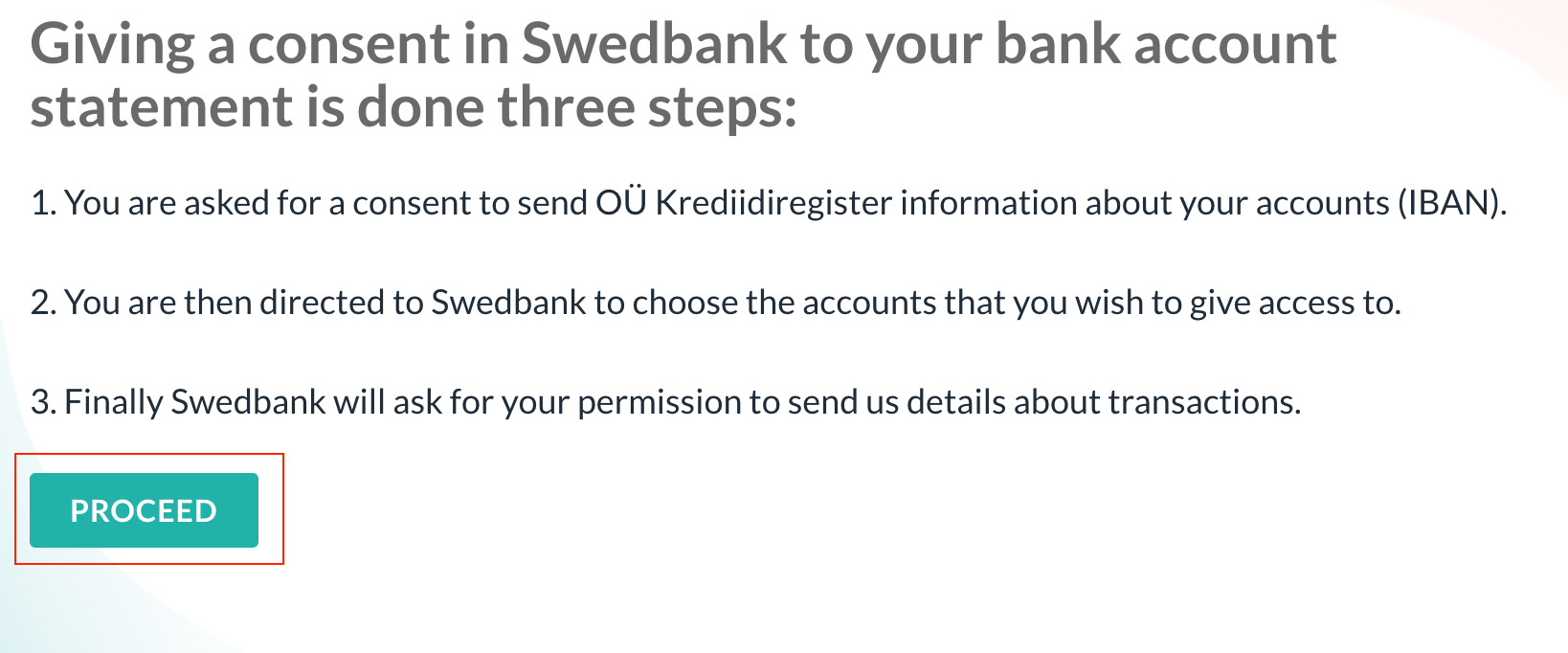

4. On the next page, select the bank where you want to log in and press the “Proceed” button. The following is described on the example of Swedbank. If you have accounts in many banks, you can select another bank next time and add them too.

5. Press “Proceed’ on the next page’’

6. Then you can sign into your bank and select the relevant bank accounts.

7. After connecting to Accountscoring and adding bank accounts, you can synchronize transactions. Open ERPLY Books again and select “Settings -> Integrations”, set the start date of the period you want to synchronize and press the yellow button “Synchronise”.

If you have any further questions, please contact us at support@erplybooks.com.