Adding tax rates for all organizations

This manual describes the option to add tax rates in ERPLY Books that will be applied to all organizations.

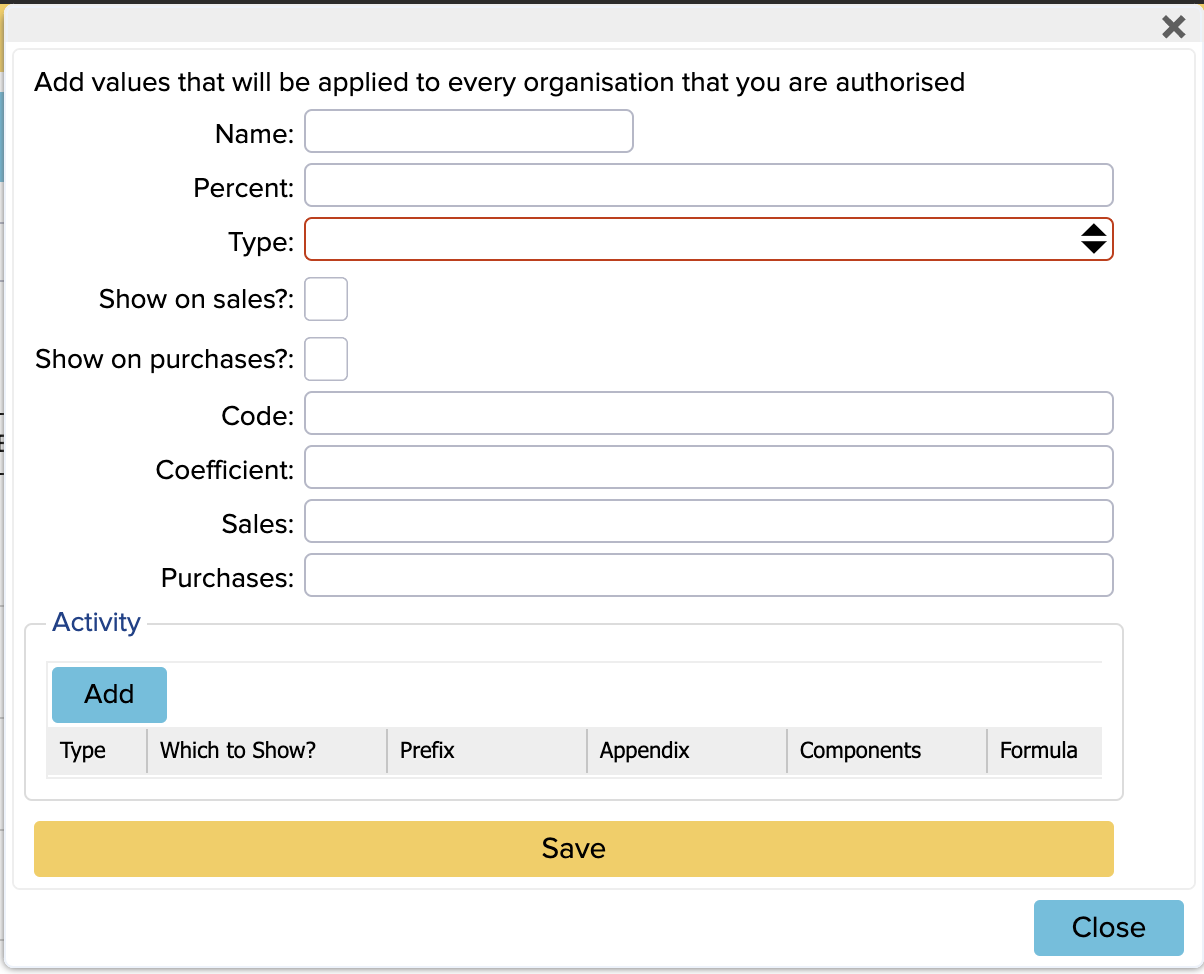

To do that, open the dashboard, search for the “Add new tax rate for all organizations” module and the following window opens:

Next, we will explain the meaning of the fields:

Name: add the tax name here

Percent: insert the tax rate percentage

Type: select the tax rate from the list

Show on sales?: activate or don’t as needed

Show on purchases?: activate or don’t as needed

Code: if you wish to use an additional feature

Coefficient: you can insert the percentage that the state will return to you (for example, a proportional deduction of the input sales tax)

Sales: write % here (if it is, for example, a reversible tax)

Purchases: write % here (if it is, for example, a reversible tax)

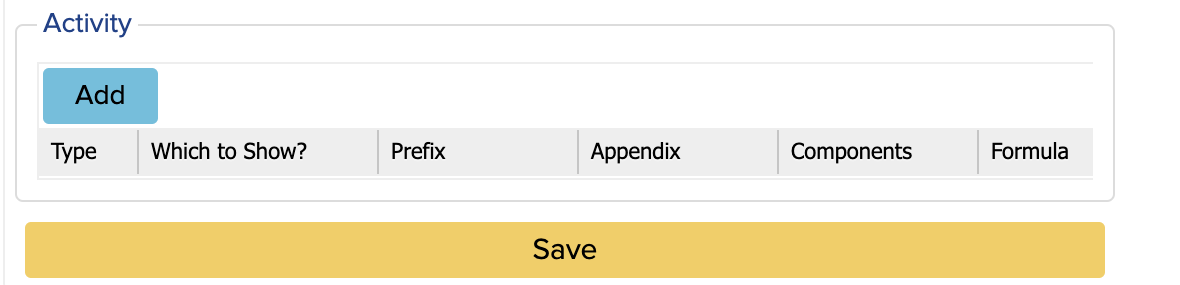

The information in the “Activity” section at the bottom of the window needs to be filled in when adding the tax and additional tax rules (e.g. reversible tax or OSS) need to be included. You can get additional information from the tax rate and reversible tax manuals, which describe the process of adding additional tax rules.

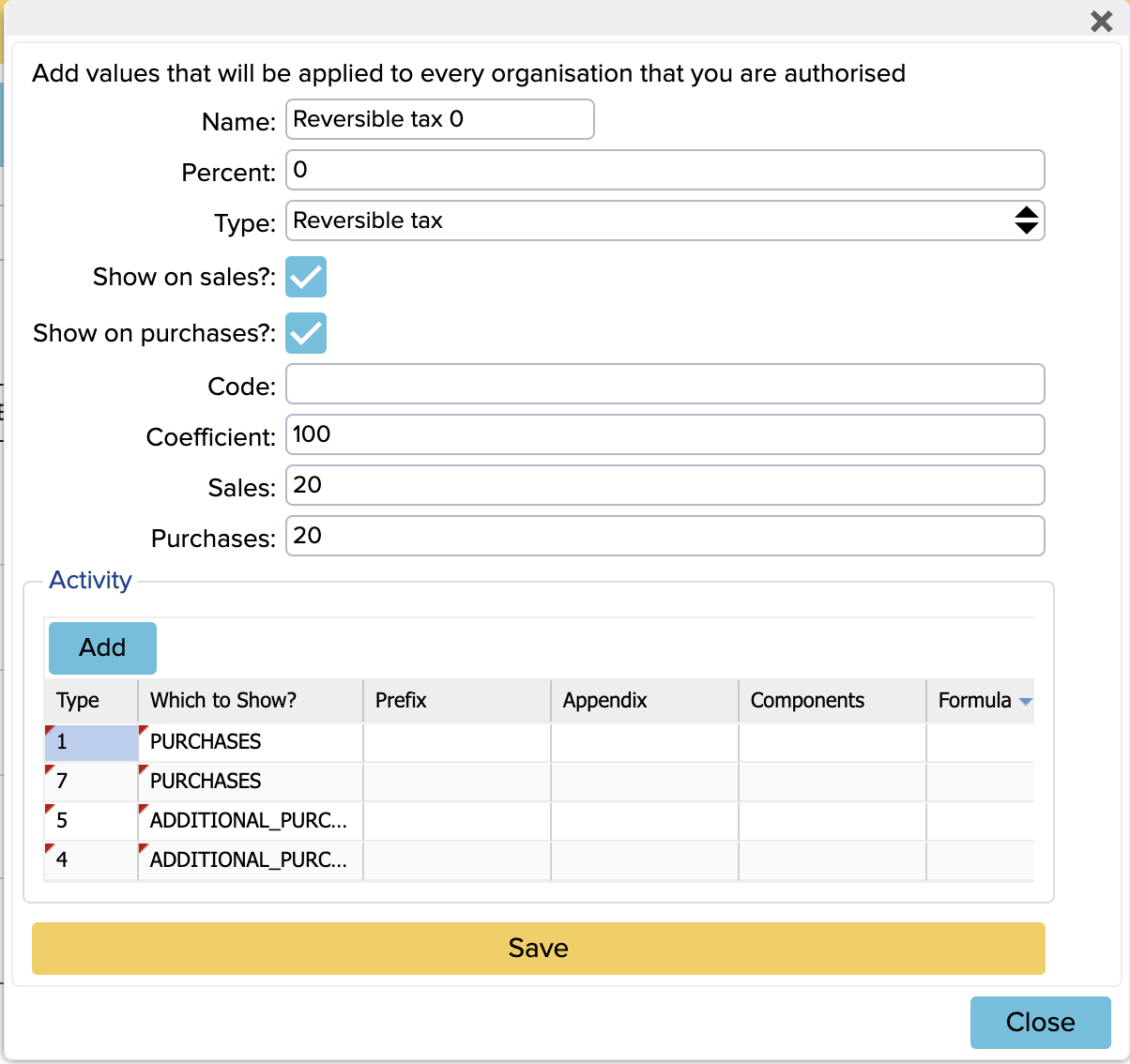

Example

In the image below, the reversible tax is set as an example:

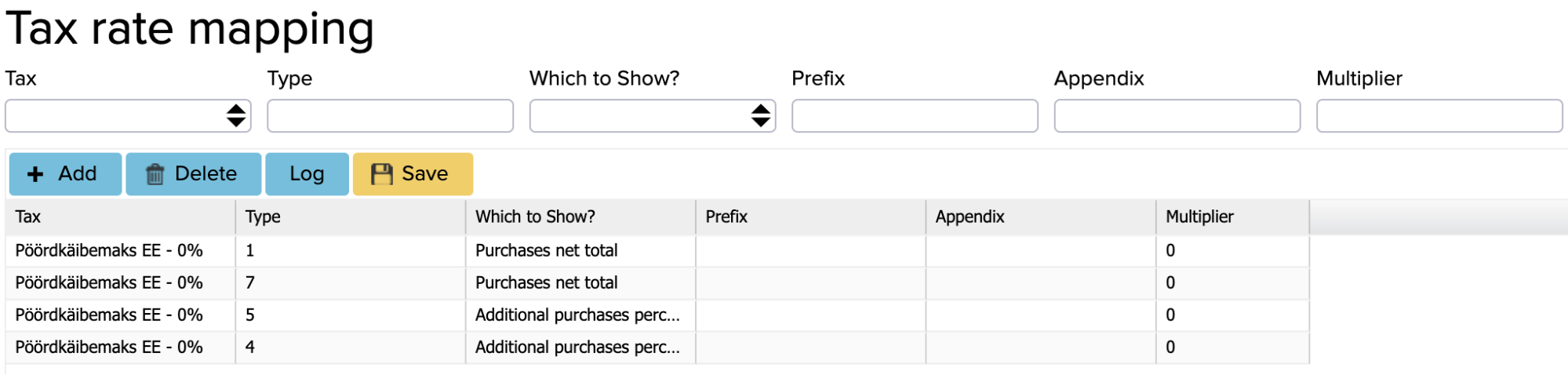

At the end, save all changes and refresh the page. Now the configured tax is applied to all organizations. You can also see the set tax rules in the “Tax rate mapping” module on the homepage.