Aggregating invoice transactions

In ERPLY Books, you can set up the aggregation of invoice entries. For every invoice row a separate transaction is created by default, but with this rule every invoice row is aggregated into one transaction. You can add this under Configuration (Settings -> Configuration).

Under Configuration find the rule named “Create minimum amount of transactions from invoices and payments”. If this rule is not activated, then a separate transaction is created for each invoice row. For example, if there are 100 rows on the invoice, then 100 transactions are also created. However, if all of these rows have the same Value Added Tax rate (VAT), then you can create one transaction with this rule.

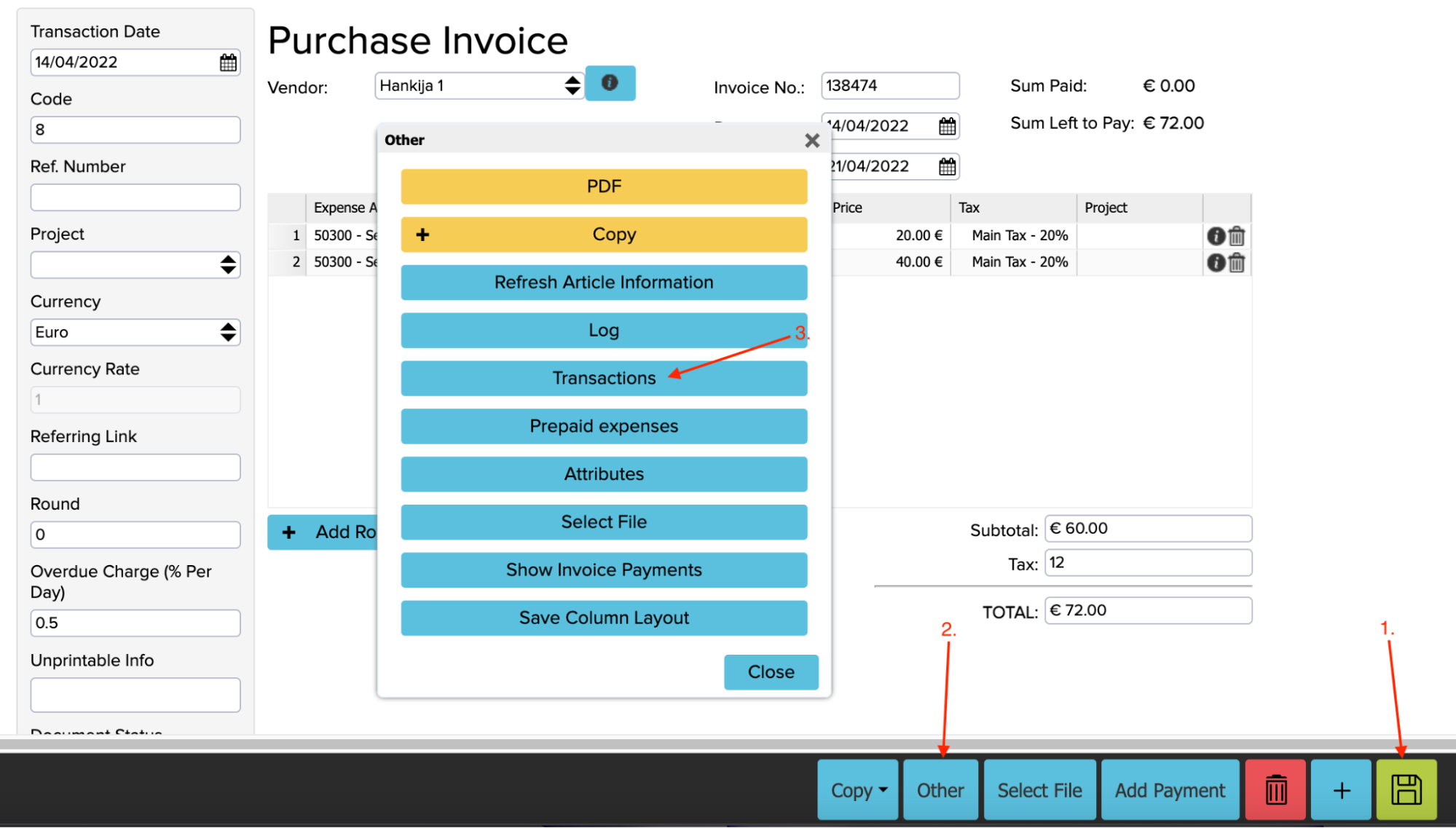

Let’s create a purchase invoice where there are two rows, for example. Add products and prices and save this invoice. Then click on “Other” and select “Transactions”.

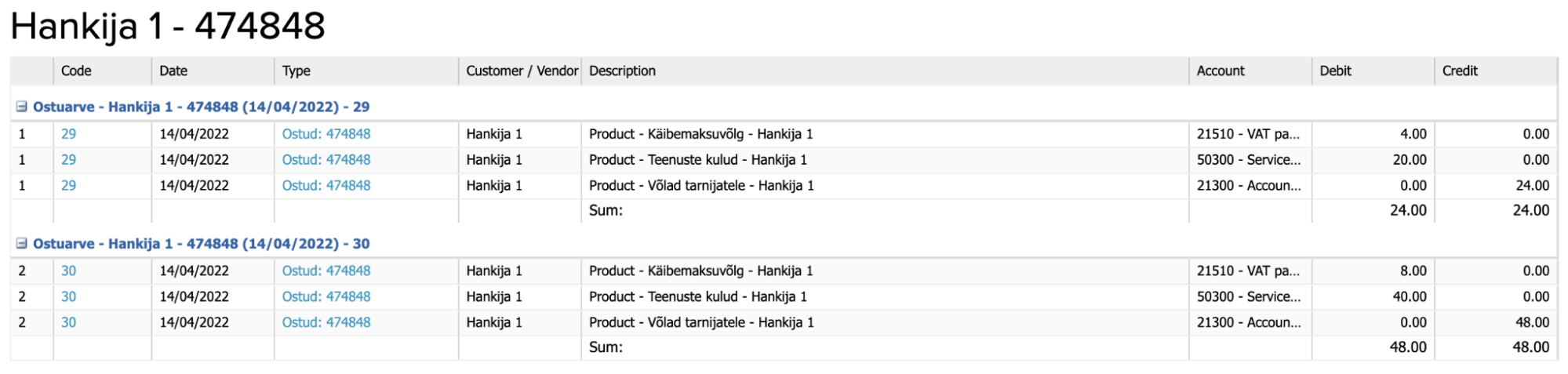

We can see that two separate transactions are created because of the two invoice rows:

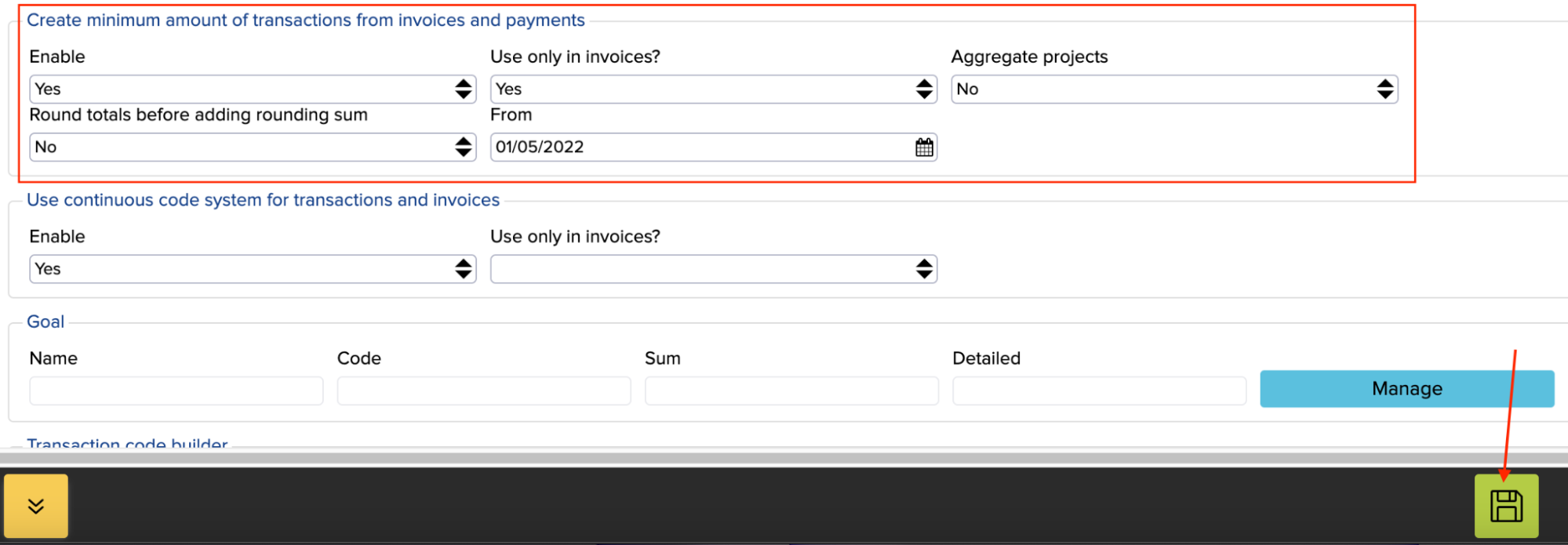

Now go to Configuration, set up the “Create minimum amount of transactions from invoices and payments” rule and create a purchase invoice again to check it.

First select “Yes” in the “Enable” cell. We recommend enabling the “Use only in invoices” cell, too, because otherwise the transactions are aggregated for the payments as well. For example, you are paying 10 different invoices and only one transaction is created, which makes it difficult to track one specific payment.

The cell “From” is the most important one because with this you determine the date from which transactions are aggregated. For example, the current month’s transactions are still made without aggregating and the rule is activated from the beginning of the next month. So if it is April right now, then we can determine that the aggregation rule is activated from 01.05.2022.

If you are finished with making changes in these cells, click on the green saving button, log out from your account and log back in.

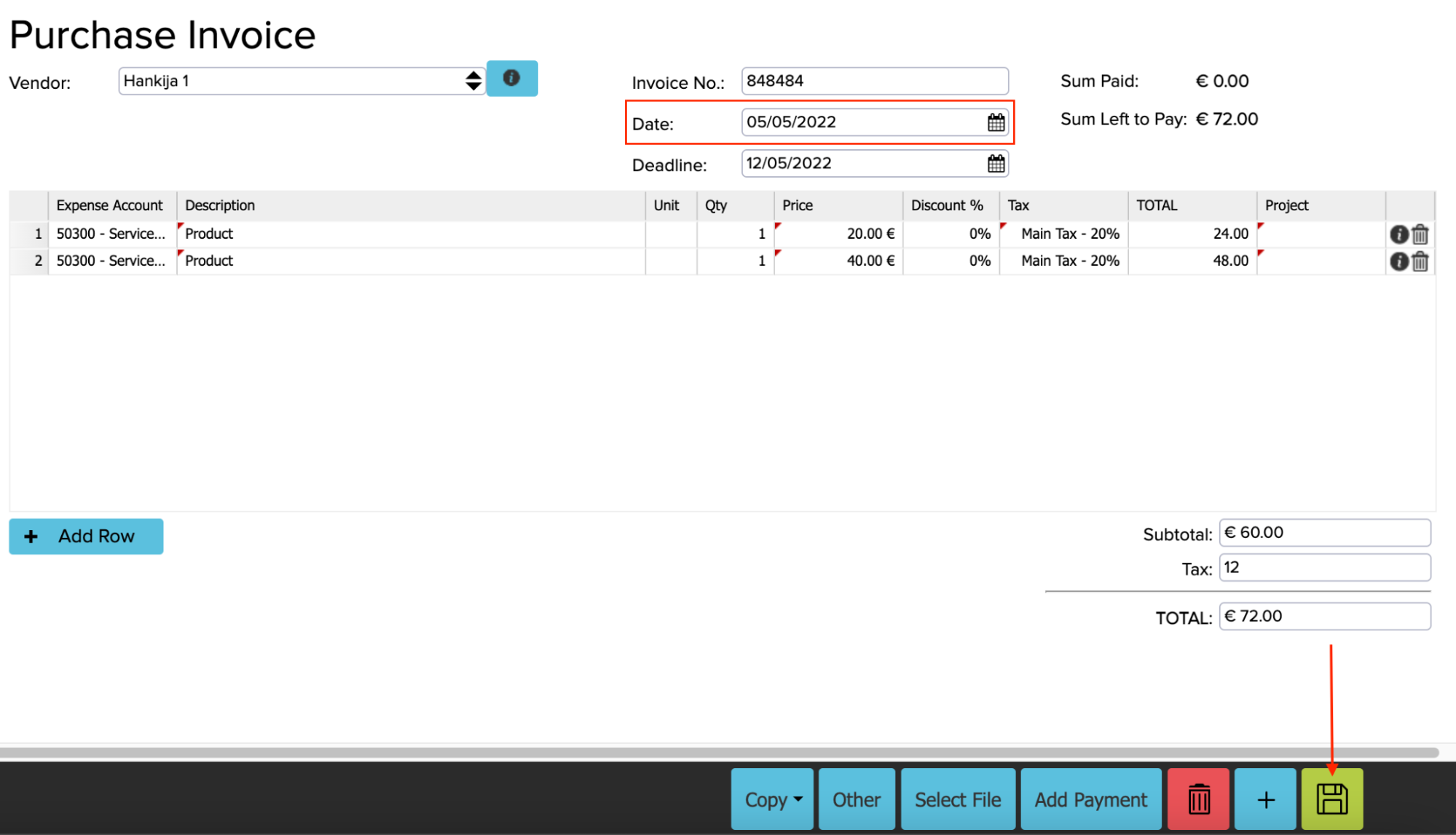

Now let’s create the same purchase invoice again with the date 05.05.2022, click on the saving button and check the transactions again (Other -> Transactions).

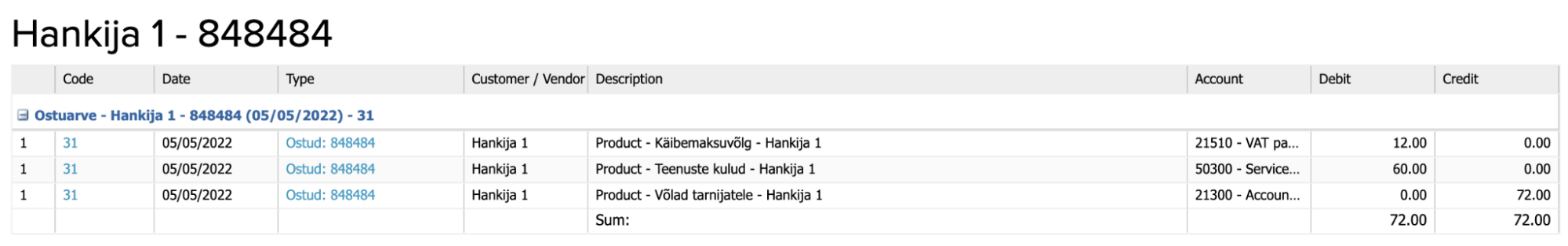

Now we can see that the rows are aggregated into one transaction:

More explanations about the aggregation rule:

“Aggregate projects“ cell – enabling this means that separate transactions are created for different Value Added Tax rates and projects are determined based on transaction rows. If you want to use aggregate projects then you also need to start using optimization plugins.

“Round totals before adding rounding sum” cell – in case the transactions are aggregated, then if the rounding should be done before or after calculating the total sum (because the transactions’ debit and credit have to be the same).